The company address provides information about the course of the company. Since it impacts operational accessibility to your audience and marketplace, you may want to know how to process it conveniently.

The process of how transfer business address in the Philippines starts at the SEC but must also be accompanied by registering that change at the Barangay, City Hall and BIR Revenue District office.

Process/requirements for change of address:

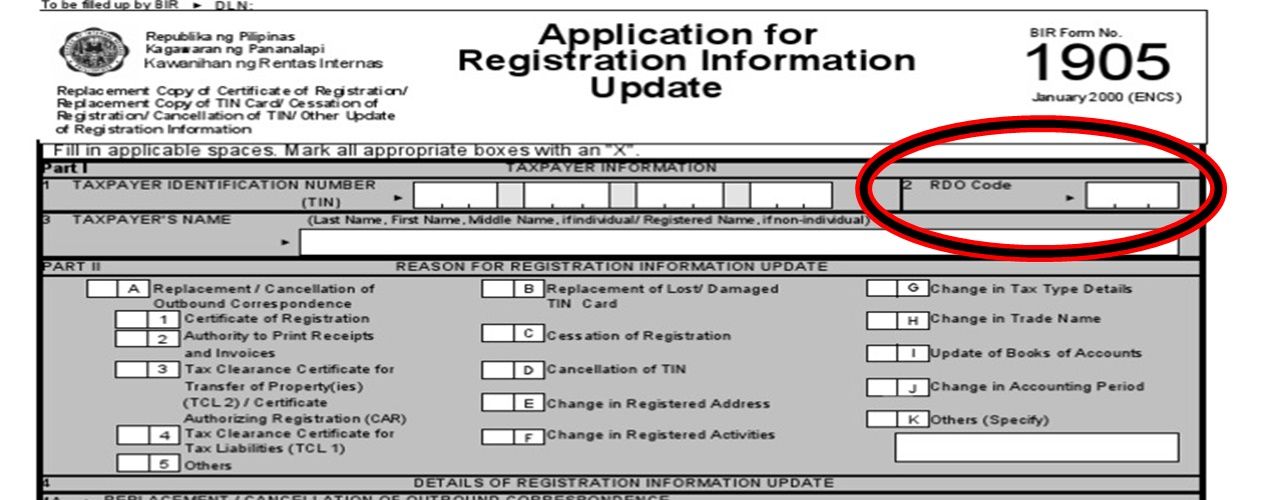

There are a few steps in transferring your business address and you might be needing documents such as form 1905 for transferring to a new RDO.

In terms of timeline, expect that it will take about 6 months or longer if the company has open cases in the BIR.

Let’s go through each step in detail.

Foreign clients are shocked at the amount of work it takes for a change of business address when they realize that it is more work than the actual process of incorporation in the Philippines.

That is because a transfer of business address is double the work of incorporating in the Philippines.

Not only do you have to do registration at all the barangay, city hall and BIR, but you also need to retire the business at each of those levels – and that BIR includes a BIR audit.

In most cases, BIR is the most demanding agency along the process because of its tough nut-to-crack process of validation.

The BIR Audit is triggered because the BIR will only allow you to retire the business when you have settled all your pending issues with the BIR.

What if you have fully complied?

Well, the BIR may have incomplete record keeping and may say that some of your company reports were missing.

In that case, print proof that it was submitted and present it to them.

Or they may say that the tax remitted was wrong.

Sometimes, they may decide to open a full audit and check everything.

When this happens be ready to present a Philippine tax lawyer so that they can present your side in the best possible light.

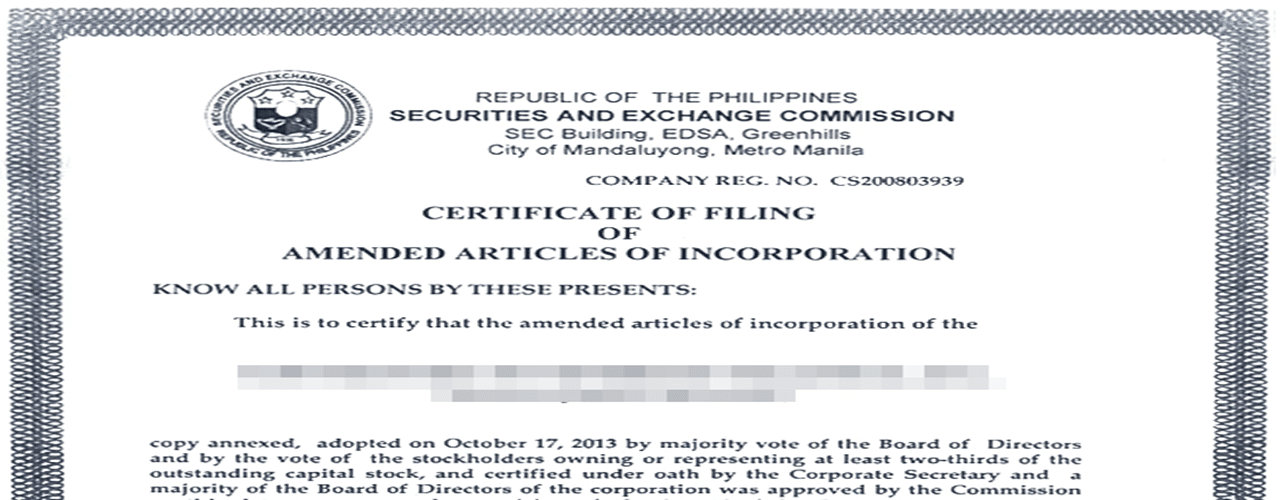

SEC requirements for change of business address Philippines just is an amendment to the Articles of Incorporation.

Articles of Incorporation are legal proof that a company is established within the state, and failure to do so is subject to penalize by SEC for violating state law.

Note please that this should be done even if the transfer of business address is merely a move to another building in the same city.

It should be done within 15 days of the company moving to the new location, as otherwise, the company may face fines.

Full list of SEC Requirements for Change of Business Address Philippines

These SEC Requirements for Change of Business Address Philippines can be submitted to the SEC online for preprocessing and computation of the exact amount to be paid.

The fee can be paid through the SEC cashier, online or at an accredited landbank branch.

Then, the hard copies of the documents and the proof of payment can be submitted to an SEC branch or office.

After the SEC has processed everything, the SEC will inform as to the date of pickup of the Certificate of Amended Articles of Incorporation.

In general, expect that the process at the SEC will take 3 or so weeks.

(Remember that the processing of all these requirements for change of address is still mostly manual, so the process can be very slow.)