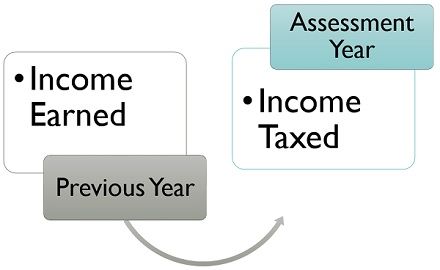

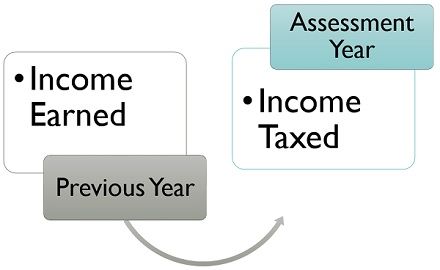

According to the Income Tax Act, income earned by a person in a financial year is taxable in the following financial year. So, the financial year in which the person has received income is called as the Previous Year. On the other hand, the financial year in which the tax liability on the income of the person is assessed is known as Assessment Year.

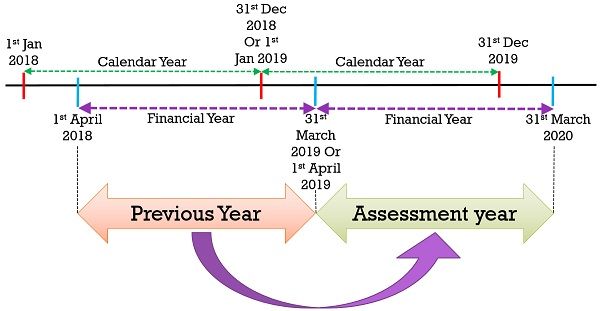

We all know that the Calendar Year commences on the 1st of January and ends on 31st of December every year. But, the calendar year has no relevance, for the purpose of accounting and taxation, as “Financial Year” is used for such purposes.

The financial statements of a company are prepared and reported across the world, as per financial year. It is a period of one year that starts on 1st April and ends on 31st March.

| Basis for Comparison | Previous Year | Assessment Year |

|---|---|---|

| Meaning | Previous Year is the financial year, in which the assessee earns income. | Assessment Year is the financial year, in which the income of the assessee earned during the previous year is evaluated and taxed. |

| What is it? | The year to which income belongs. | The year in which income tax liability for the previous year arises. |

| Term | Its term is 12 months or less. | Its term is 12 months. |

Previous Year indicates the financial year immediately preceding the assessment year. It is the year in which a person or entity earns income, which becomes taxable in the assessment year. In Income Tax Act, 1961, the term ‘previous year‘ is defined under section 3.

Previous Year is a period of 12 months, but it can be shorter than that too, such as in the case of a newly set up business or profession, the previous year will be less than 12 months, starting from the date of commencing the business and ending on 31st March of that financial year.

Further, if a source of income commences in a particular financial year, then also the previous year begins from the date on which the income generation starts and ends on the 31st March, of that particular financial year.

It is a common rule that the income of the previous year is assessed in the immediately following financial year. However, there are certain instances when the income of the previous year is assessed in the same year. These are:

Assessment Year, as the name signifies, is the year in which income of the person is assessed, i.e. verified, and taxed. Here the word ‘person’ covers Individual, Hindu Undivided Family (HUF), Association of Persons (AOP)/Body of Individual (BOI), Partnership Firm, Local Authority, Company or Any artificial juridical person.

In the Income Tax Act, 1961, the term ‘assessment year‘ has been defined under section 2 sub-section 9, which describes it as a period of 12 months starting from 1st of April every year.

Hence, the financial year to which the income belongs is termed as the previous year, and the immediately succeeding financial year in which the income of the assessee is evaluated, the income tax return is filed, the tax liability is computed and becomes due for payment, is termed as the assessment year.

Further, the due date for filing an income tax return for the previous year, in the assessment year will be:

The main differences between previous year and assessment year are given hereunder:

Mr X earned ₹40 lakhs as income in the year 2018-19, which is taxable in the immediately following year, i.e. 2019-20. So here the previous year will be 2018-19, as Mr X earned income in this year, whereas 2019-20 will be the assessment year, as it is the year in which the income earned by him in the previous year will become taxable. Further, the income earned in 2019-20, will be assessed and taxed in the next financial year, i.e. 2020-21.

Therefore, Every previous is the assessment year for the immediately preceding financial year, i.e. previous year, subject to certain exceptions, which we have already discussed in this article.

You might have noticed that Income Tax Forms have Assessment year and not Previous year because income for a particular financial year is computed and taxed in the assessment year only. This is due to the fact that tax cannot be levied on the income before it is earned.

Moreover, there are some instances when assessees lose their job or find a new one, or they make a new investment, or generates income from a new source, etc. begins in the middle or end of the financial year. And due to this reason assessment starts after the financial year in which the income is earned, ends. Therefore, the assessees have to opt their Assessment Year, while filing their return.